Seamless intra-Africa trade is the next phase in the continent’s extraordinary growth trajectory. With billions of dollars of trade currently hampered by inefficiently connected financial services, this newly launched innovation is poised for great things.

African money is on the move. It’s part of a continent-wide shift to remove the barriers between its markets and help trade flow more easily. Intra-regional trade has enormous potential, but historically, a fragmented financial system spread across multiple countries led to many missing out – or paying more than they needed to do business with their neighbors.

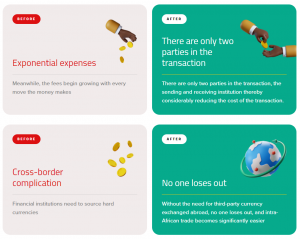

Developed and supported by the region’s leading institutions; the African Export-Import Bank (Afreximbank, The African Union, and the African Continental Free Trade Area (AfCFTA), the Pan African Payment & Settlement System (PAPSS) is a new Financial Markets Infrastructure estimated to save the continent more than USD $5bn in payment transaction costs per annum.

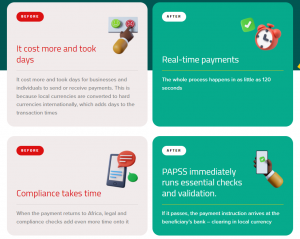

Previously, businesses suffered what was essentially a penalty for intra-African trading.

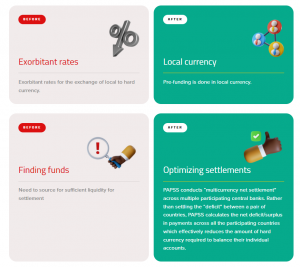

This figure is a culmination of tax, fees, and third-currency costs. Previously, businesses suffered what was essentially a penalty for intra-African trading. With the value of local currencies always in flux, the difference between two different currencies is most often settled in a third hard currency, usually the dollar. With PAPSS, users can pay and receive transactions in their home currency, which means the reliance on dollars drastically lowers.

Following a successful pilot in the 6 countries of the West African Monetary Zone (WAMZ), PAPSS is now launched to a broader customer base in late 2021. Interestingly, not only will this platform optimize existing trade, but it will also help to formalize informal trade on the continent – estimated to be worth $40bn dollars.

PAPSS exists to make sure payments can happen instantly across African borders – in local currency. This cuts down on the costs of using a third currency, usually US dollars, and the time it takes to process transactions.

There are three core processes to make sure this happens quickly: Instant payments, pre-funding, and net settlement.

All of this is possible thanks

to advances in collaboration. Technology is being leveraged to enable a new level of coordination between the region’s central banks, with Afreximbank supporting the multilateral net settlement through a shared infrastructure.

Instant and binding credit to accounts is backed up by a transparent messaging system, which uses global standards to update all stakeholders. The financial data generated by the transaction is stored and presented in a useful format, increasing efficiency, and improving reporting, and meeting regulatory requirements.

Crucially, PAPSS is not here to replace or even compete with existing financial services. It’s a complementary service that can expand their potential customer based. Ultimately, the power of PAPSS is in its ability to connect and collaborate with every financial institution in Africa.

As much as the world is a more connected place, essential financial services have lagged for too long. With the introduction of PAPSS, it’s a sign that modern Africa is moving into a new phase – fueled by new financial infrastructure and made possible through collaboration.

Learn more by visiting https://papss.com

![EC Announces Elimination of Indelible Ink in Upcoming Elections [Video]](https://newsonghana.com/wp-content/uploads/2023/12/image-351-218x150.png)